Calendar Year Tax – “Taxpayers have extra time – up to six months after the due date of the taxpayer’s federal income tax return for the disaster year (without regard to any extension of time to file) – to make the . Abu Dhabi: The Federal Tax Authority (FTA) clarified on the registration timelines for those who are to pay corporate tax, to further explain the specific deadlines for different categories of taxable .

Calendar Year Tax

Source : www.investopedia.com

Difference Between Fiscal Year and Calendar Year | Difference Between

Source : www.differencebetween.net

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

What Is a Tax Year?

Source : www.thebalancemoney.com

Property Tax Prorations Case Escrow

Source : caseescrow.com

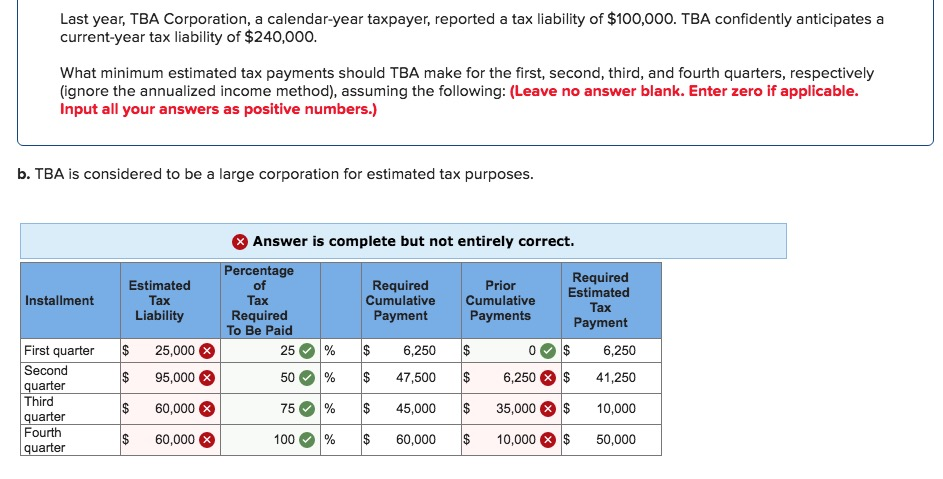

Solved Last year, TBA Corporation, a calendar year taxpayer

Source : www.chegg.com

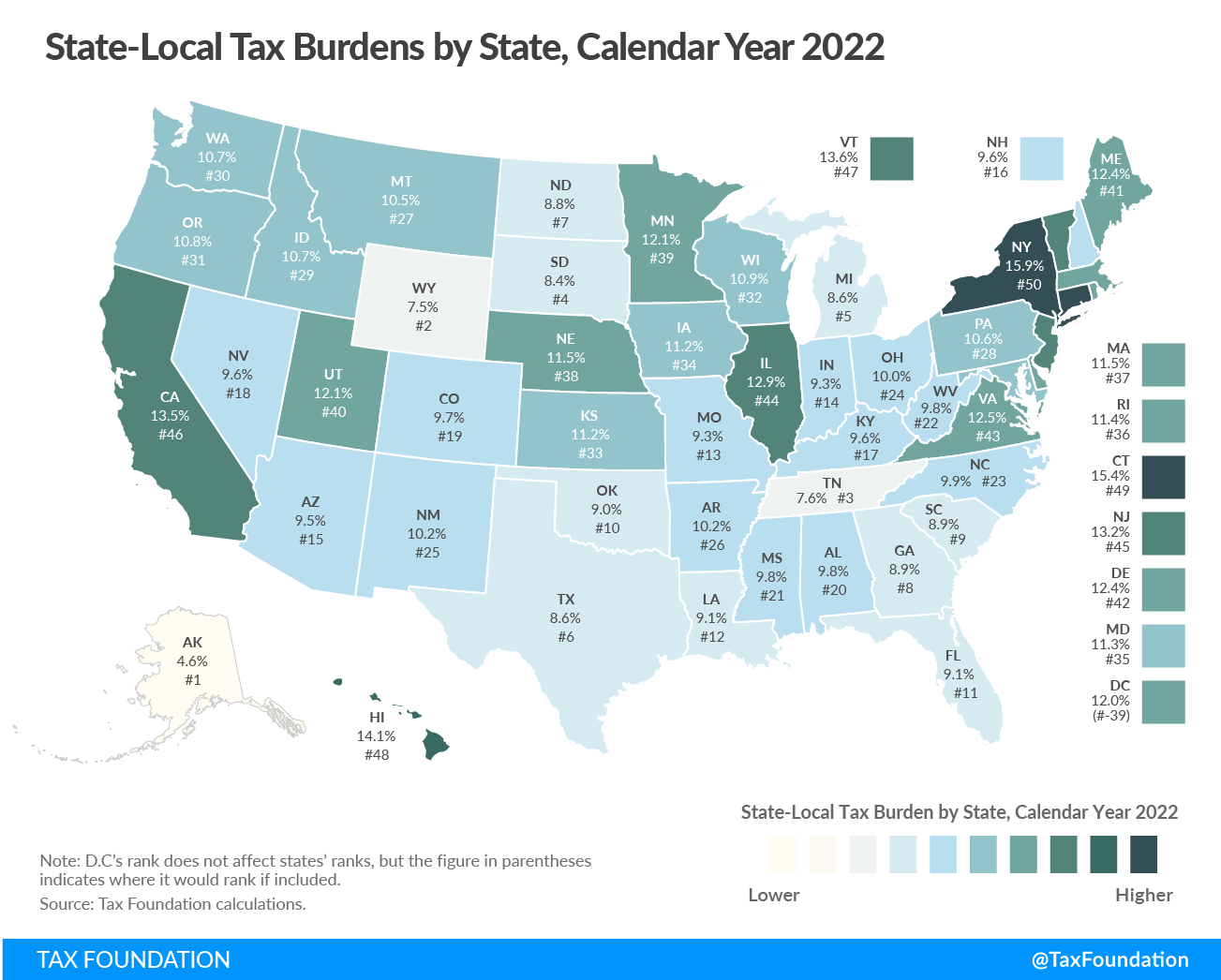

Tax Burden by State: 2022 State and Local Taxes | Tax Foundation

Source : taxfoundation.org

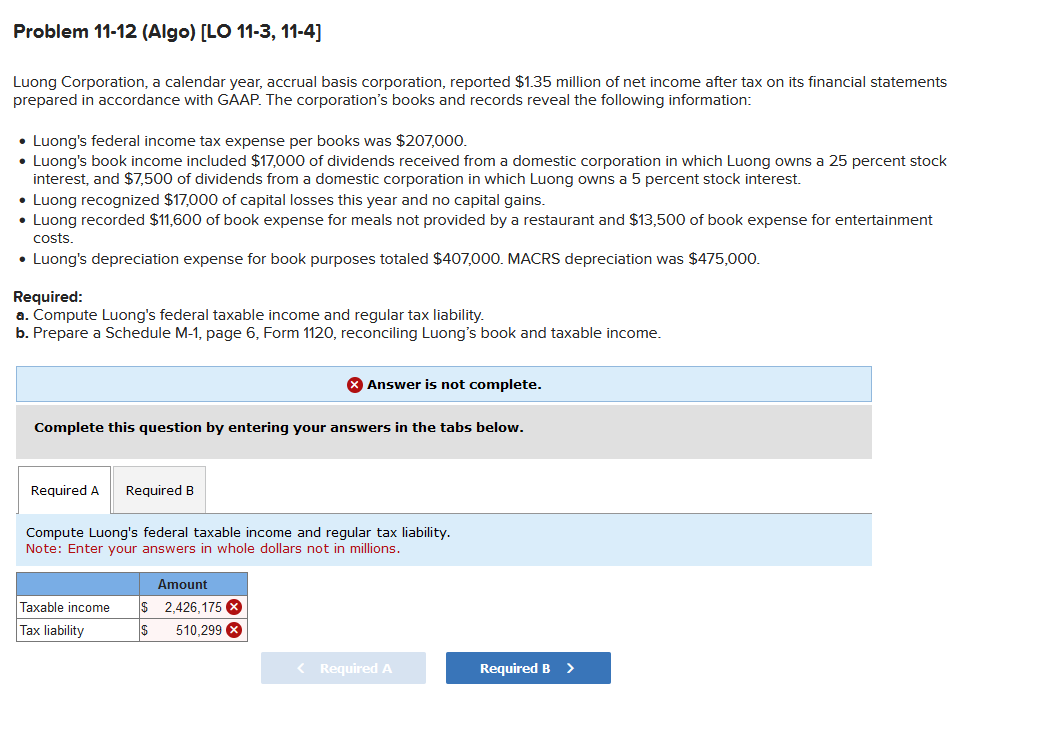

Solved Luong Corporation, a calendar year, accrual basis | Chegg.com

Source : www.chegg.com

Tax Burden by State: 2022 State and Local Taxes | Tax Foundation

Source : taxfoundation.org

3 charitable ways to reduce your tax burden before calendar year

Source : giving.duke.edu

Calendar Year Tax What Is the Tax Year? Definition, When It Ends, and Types: The rules guiding the inheritance of an individual retirement account (IRA) when the IRA owner dies are complicated, but at least one aspect is straightforward: Whether a spouse or non-spouse is named . Calendar items must be submitted at least six days before an event. Items are only guaranteed to publish once prior to the event. To guarantee placement in the paper on a particular day, organizations .

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/tax-year-defined-1293735_final_rev_3_25_21-92ca8c2a3f9c4515ad8b71d04f4d4b0d.png)